Learn About Stock Options in 10 Minutes

Stock Options 101

I agree.

For a beginner, stock options can be confusing but I am famous for teaching

things in 10 minutes haha. (I never had formal education in Accounting

but to finish my MBA in fewer semesters, I challenged Accounting course

to get full credit without 'wasting' a semester on it! Now I can teach

basics of accounting to anyone in one hour though I never had any formal

classroom education ;) Probably an engineer's way of learning and teaching

things LOL)

What

are options? They are like insurance policies.

When you buy an insurance, you pay some premium. Your insurance

company, like Allstate, Geico etc., sell insurance policy to you and

in return they get the premium that you are paying.

* When you buy insurance, you get protection against some risks.

You have the right to ask the insurance

company to reimburse you for certain events/losses. To obtain some RIGHT,

you have to Pay for it.

* Insurance company, as a seller, is under obligation to reimburse you as per terms of the policy. For willingly assuming

obligation (or to sell some Right to someone to demand things

from you which are unfavorable to you), the other party has to compensate or pay something. .

Let us get to stock options now. (Forget about Expiration, strike price,

alpha, beta, gamma, theta, etc- the whole soup of alphabet. You will learn about all that in Stock

Options 102 if and when I have some more time ;) )

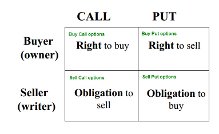

Call, Put- these are two types of options. Call option is related to BUY (but you can BUY a CALL option or you can SELL a CALL Option) and put option is related to sell (but you can BUY a PUT option or you can SELL a PUT option). Sounds confusing, right? It is but you have to understand that, in total, you can trade options in 4 ways. Understand the following and your confusion will be over. Forever.

- Buy a Call option- you get (buy) the RIGHT to BUY underlying stock, at your will at some predetermined price over the

life of the contract, in exchange for paying some money/premium

now.

Nothing is free in the world. If you want to be able to demand something from someone or want to be able to make someone do something for you at your will, you have to pay for it. Doesn't this seem very real life situation?? - Sell a Call option- you are willing to take the OBLIGATION to SELL the underlying stock, to the buyer of the Call option

at the specific predetermined price any time buyer demands over the

predetermine time period, in return for getting paid some money/premium

now.

- Buy a Put option- you get the RIGHT to SELL underlying stock, at your will at some predetermined price over some predetermined time period, in exchange for paying some money/premium now.

- Sell a Put option- you get the OBLIGATION to BUY the underlying stock, from the buyer of the Put option at the specific predetermined price any time he/she demands over the life of the contract. For your willingness or for agreeing to be acted upon, at someone's demand, even if that could mean some big losses to you, you would want to be compensated, wouldn't you? As a seller, buyer will have to pay you some money/premium now.

Assume we are talking about Facebook (FB) options with strike price of $50. Assume that the FB stock price is right now $49.75. CALL options for the current month are trading at $1 and put options are trading at $1.15. Each option is for 100 Facebook stocks. Let us ignore commissions. Remember if you BUY or SELL, CALL or PUT options, you pay commission to your broker.

| Option Type | Actions | Premium | What you can do? | Why would you trade this? |

| Call Option | Buy Call Option | You PAY the premium of $1.00 per share (to the Seller of the option). 1 contract is for 100 shares so you Pay $100/contract | You have the RIGHT to BUY Facebook stocks at $50 from the seller of this option | For $100/contract maximum risk, you want to profit if Facebook stock goes up. |

| Sell Call Option | You GET the premium of $1.00 per share (that the Buyer pays). 1 contract is for 100 shares so you get paid $100/contract | You have the OBLIGATION to SELL Facebook stocks at $50 to the buyer of this option | You believe that Facebook stock is not going to go up. Will go down or stay where it is. Maximum profit you get is $100/contract! | |

| Put Option | Buy Put Option | You PAY the premium of $1.15 per share (to the Seller of the option). 1 contract is for 100 shares so you Pay $115/contract | You have the RIGHT to SELL Facebook stocks at $50 from the seller of this option | For $115/contract maximum risk, you want to profit if Facebook stock goes down. |

| Sell Put Option | You GET the premium of $1.15 per share (that the Buyer pays). 1 contract is for 100 shares so you get paid $115/contract | You have the OBLIGATION to BUY Facebook stocks at $50 to the buyer of this option | You believe that Facebook stock is not going to go down; it will go up or stay where it is. Maximum profit you get is $115/contract! |

Based on the table above, I know 90% of you would think why SELL Call or Put options when you have unlimited exposure to risk for few dollars of profit opportunity!! You would think it is smart to BUY options. Based on my experience (and wild guesses), 50-60% of the time, options expire worthless. Around 20-30% of the time, options are in money but buyers will get less than what they have paid for and only in remaining cases, buyers will get more than what they have paid for. Only in rare cases, buyers will strike it rich in an option position. It is a fair game overall. What matters is not the maximum or minimum loss or profit exposure but a good/correct outlook or opinion about the near-term price movement of the underlying stock! (Btw, in 90% of the times, I SELL options. Very rarely, I buy them. If I am thinking to short some stock, I prefer to sell Call options on it. If I am thinking to go long on some stock, I prefer to sell Put options on it.

When and how

you would trade these options

* Pure speculation at minimum risk- buy Call or

buy Put options.

* Already

have some stocks but in no rush to sell them? Sell Call options so you can get more for your stocks later than what you can get now

IF STOCK CONTINUES TO GO UP. If stock does not go up, you got to keep

the Premium/free money/a sort of income on your holding.

* Thinking to buy some stock? You can Sell some PUT options nowso you get the opportunity to buy stocks later for less money

that what you have to pay right now IF STOCK CONTINUES TO GO DOWN. If

stock does not go down much from current price-level, you got to keep

the Premium/profit/free money.

Options Trading Chart if you have opinion on the stock's trend and/or the volatility.

|

Your

view.... |

Bullish |

Bearish |

Undecided |

|

Volatility

Rising |

Buy a Call | Buy a Put | Buy a call and Buy a Put at the same strike (Long Straddle) or at different strikes (Long Strangle) |

|

Volatility Falling |

Sell a Put | Sell a Call | Sell

a call and sell a put at the same strike (Short Straddle) or at different strike (Short Strangle) |

|

Volatility

Undecided |

Buy

a call and sell a call at a higher strike OR Buy a put and sell

a put at a higher strike. Or buy a future contract |

Buy

a put and sell a put at a lower strike OR Buy a call and sell

a call at a lower strike. Or sell a future contract |

Go to Las Vegas and gamble there. It will give you at least some more fun. |